Electric car tax benefits UK are bigger than ever in 2025—especially if you choose a Kia EV from Todds of Campsie. Below you’ll find every incentive that matters to directors, finance managers and company-car drivers.

3 % Benefit-in-Kind (BiK) for zero-emission cars in 2025/26—rising slowly to 4 % in 26/27 and 5 % in 27/28.

£10 first-year Vehicle Excise Duty (VED), then the standard rate (£195 today).

100 % First-Year Allowance (FYA) on new electric cars and charge-points until 31 March 2026.

Employer-provided home or workplace charging electricity is tax-free.

7 p/mile Advisory Electricity Rate (AER) reimbursed to employees tax-free.

EVs remain exempt from ULEZ and every current UK Clean-Air Zone charge.

| Tax Year | Kia EV BiK Rate | Typical Diesel BiK | Tax on Kia EV* | Tax on Diesel* | Annual Saving |

|---|---|---|---|---|---|

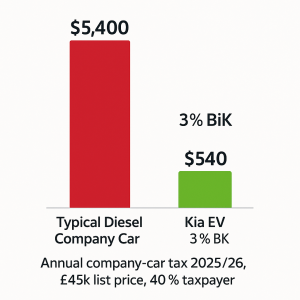

| 2025/26 | 3 % | 30 % | £540 | £5,400 | £4,860 |

| 2026/27 | 4 % | 30 % | £720 | £5,400 | £4,680 |

| 2027/28 | 5 % | 31 % | £900 | £5,580 | £4,680 |

*Assumes £45,000 P11D value and 40 % taxpayer.

Buy a £47,000 Kia EV6 GT-Line through your limited company before 31 March 2026 and you can deduct the full cost from profits in year 1. For a 19 % corporation-tax payer that’s an £8,930 cash-flow boost compared with slow 18 % writing-down allowances.

Plug-in Van Grant: up to £5,000 off large electric vans—ideal for the incoming Kia PBV.

Workplace Charging Scheme: 75 % (max £350) per socket on up to 40 points.

Electricity supplied by the employer—at work or reimbursed for home charging—remains a non-taxable benefit.

Domestic charging draws only 5 % VAT, while petrol or diesel attracts fuel duty plus 20 % VAT. Using HMRC’s 7 p/mile AER, businesses can reimburse drivers tax-free and reclaim the VAT on business electricity.

| Energy Source | Unit Cost | Cost for 10,000 mi** | VAT | CO₂ Emitted |

|---|---|---|---|---|

| Petrol | £1.55 / l | £2,600 | 20 % | 2.4 t |

| Home Charge | 15 p / kWh | £430 | 5 % | 0 t |

| Public Rapid | 65 p / kWh | £1,850 | 20 % | 0 t |

Kia EVs breeze through London ULEZ, Birmingham CAZ, Bristol CAZ, Sheffield CAZ, Newcastle CAZ and all Scottish LEZs at zero cost. London’s £15 congestion charge stays off the bill until at least 24 December 2025, with discounts planned thereafter.

The 100 % FYA clock is ticking, and BiK will edge up each April. Ordering your Kia EV now locks in today’s 3 % BiK and full corporation-tax write-off while stock is available.

Specialist Business Team that translates HMRC jargon into real money.

Kia’s 7-Year Warranty—ideal for longer fleet cycles.

Range from Niro EV to EV9—every role, every budget.

Turn-key Charging Solutions handled in-house so you secure the Workplace Grant.

“Try Before You Buy” Demo Pool for SMEs in Northern Ireland.

Ready to save? Book a free tax-savings consultation at ToddsOfCampsie.com/EV-Tax or call 028 71811611 today.

Electric cars are no longer a green luxury – they are a tax-efficiency tool. By partnering with Todds of Campsie and choosing a Kia EV, businesses can harvest four-figure annual savings, employees pay pennies in BiK, and everyone drives into 2025-style low-carbon zones with zero hassle. Secure your allocation before the April 2026 changes land – your balance sheet (and the planet) will thank you. Unlock the electric car tax benefits uk to your business.

Disclaimer: These electric car tax benefits uk Tax rules correct to 25 June 2025. Incentives may change; always seek professional advice for your circumstances.

Todds of Campsie

6 Courtauld Way

Campsie Industrial Estate

Londonderry

BT47 3DN